Corporate Transparency Act 2025 Exemptions. As this excerpt on applicable exemptions indicates, the good news is that many businesses will not be subject to a reporting requirement: An entity that qualifies under any of these 23 exemptions will not need to file a boi report, unless the company later becomes nonexempt.

On january 1, 2025, corporate transparency act (the “cta”) went into effect and “reporting companies” in the united states are required to disclose information regarding its beneficial owners. The corporate transparency act (cta) imposes new federal reporting requirements on many domestic and foreign businesses operating in the u.s.

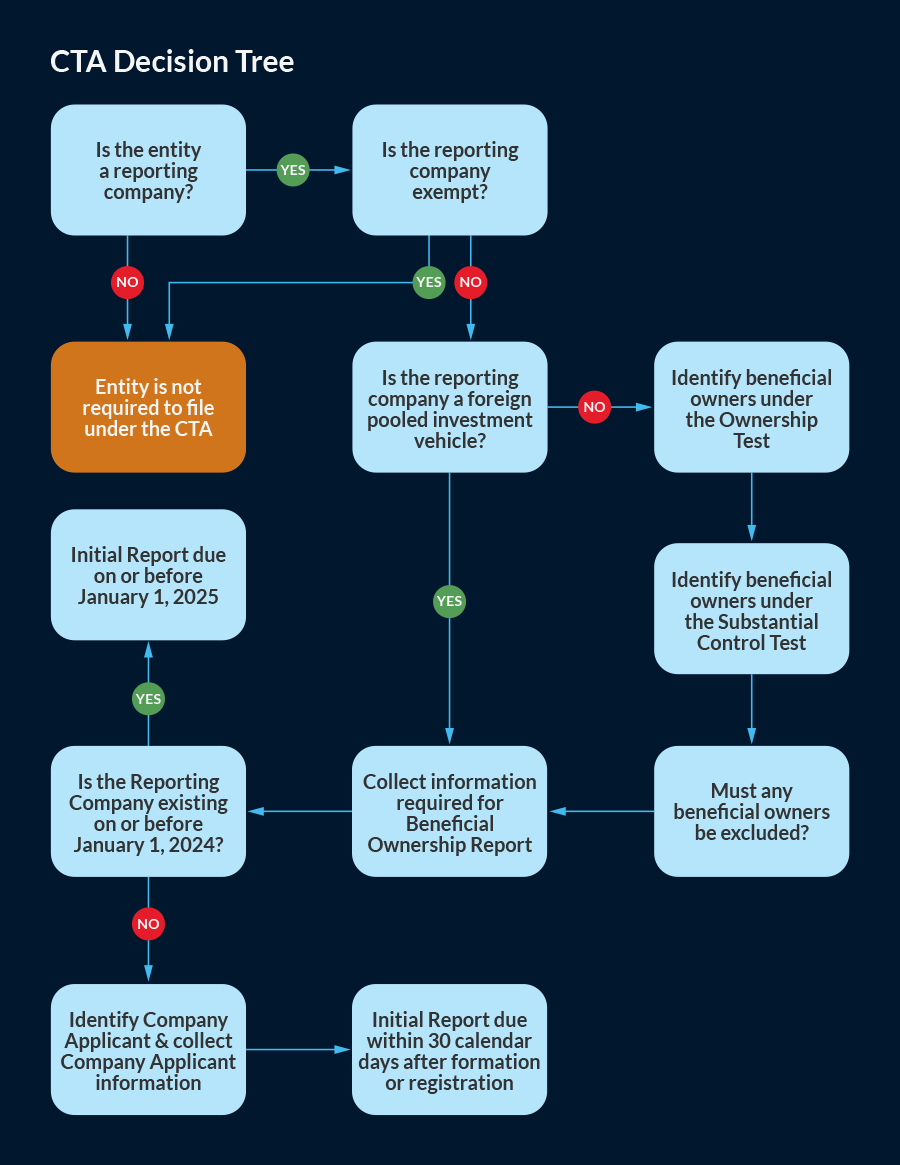

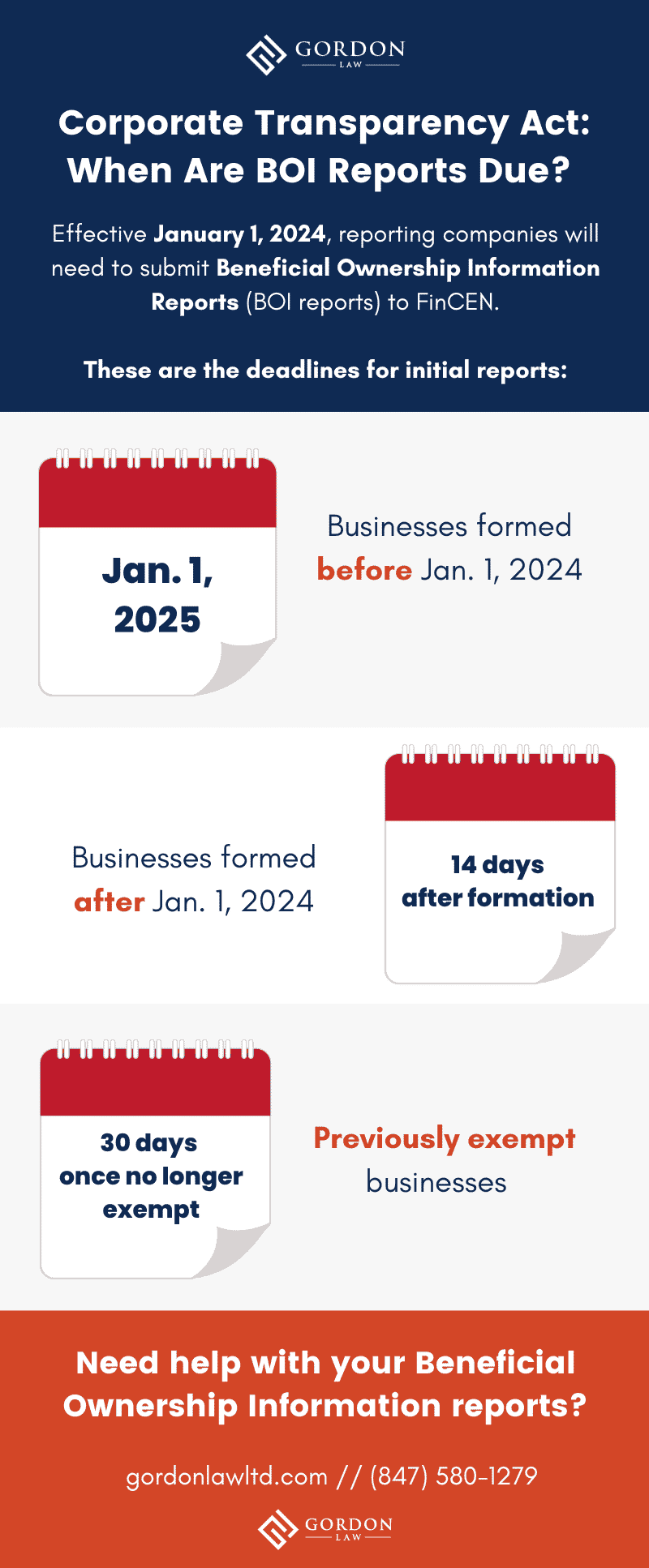

Beginning january 1, 2025, the us corporate transparency act (cta) will require “reporting companies” to submit a report to the financial crimes enforcement network (fincen) containing personal information about the reporting company’s “beneficial owners.” reporting companies formed before january 1, 2025, will have until.

The corporate transparency act of 2021 (cta), effective january 1, 2025, brings new compliance burdens and potential hefty penalties.

Corporate Transparency Act 2025 Exemptions Alyce Bernice, That adds up fast, so it is always. In case you missed it, the nsba won a summary judgment in march of 2025, preventing the corporate transparency act's boi reporting requirements from.

Corporate Transparency Act Will Begin In 2025 Lonni Randene, On january 1, 2025, corporate transparency act (the “cta”) went into effect and “reporting companies” in the united states are required to disclose information regarding its beneficial owners. Under the rule, a beneficial owner includes any individual who, directly or indirectly, either (1) exercises substantial control over a reporting company, or (2) owns or controls at least 25 percent of the ownership interests of a reporting company.

An Overview of the US Corporate Transparency Act Bolder Group, On march 1, 2025, in the case of national small business united v.yellen, no. Ala.), a federal district court in the northern district of alabama, northeastern division, entered a final declaratory judgment, concluding that the corporate transparency act exceeds the constitution’s limits on congress’s power.

Corporate Transparency Act 2025 Exemptions Alyce Bernice, The corporate transparency act of 2021 (cta), effective january 1, 2025, brings new compliance burdens and potential hefty penalties. Beginning on january 1, 2025, the corporate transparency act (the “cta”) will require all “reporting companies” to report to the federal financial.

Corporate Transparency Act 2025 Exemptions Effie Gilberte, Learn how the cta impacts small businesses across financial services, healthcare, manufacturing, professional services, and technology. Beginning on january 1, 2025, the corporate transparency act (the “cta”) will require all “reporting companies” to report to the federal financial.

An Introduction to the U.S. Corporate Transparency Act, The rule defines the terms “substantial control” and “ownership interest.”. Failure to accurately and timely file will result in significant fincen (u.s.

Corporate Transparency Act 2025 Full Textbook Pdf Julee Genovera, On january 1, 2025, corporate transparency act (the “cta”) went into effect and “reporting companies” in the united states are required to disclose information regarding its beneficial owners. Learn who it affects and more.

Corporate Transparency Act 2025 Full Text Pdf Phedra, Understanding the corporate transparency act (cta): Failure to accurately and timely file will result in significant fincen (u.s.

Corporate Transparency Act Exemptions What you need to know, Department of treasury’s financial crimes enforcement network) penalties,. Beginning on january 1, 2025, the corporate transparency act (the “cta”) will require all “reporting companies” to report to the federal financial.

How To File Corporate Transparency Act 2025 Korie Thelma, Llcs, corporations, and other entities created or registered through a filing with the state must submit a beneficial ownership information (boi) report to fincen unless they qualify for. Department of the treasury’s financial crimes enforcement network (fincen).