Social Security Wage Limit 2025 Percentage. The 2025 social security (also known as oasdi) tax rate will remain 6.2% with a taxable wage base of $176,100, an increase of $7,500 from $168,600 in 2025. This means any dollar over that amount is exempt from social security payroll taxes, which are either 6.2% if you have an.

The wage base or earnings limit for the 6.2% social security tax rises every year. For 2025, the ssa has set the cola at 2.5%.

Social Security Tax Wage Limit 2025 Lok Mary Anderson, This means any dollar over that amount is exempt from social security payroll taxes, which are either 6.2% if you have an.

Social Security Limit 2025 Increase Warren Metcalfe, But those who do everything they can to maximize their earnings during their career could end up.

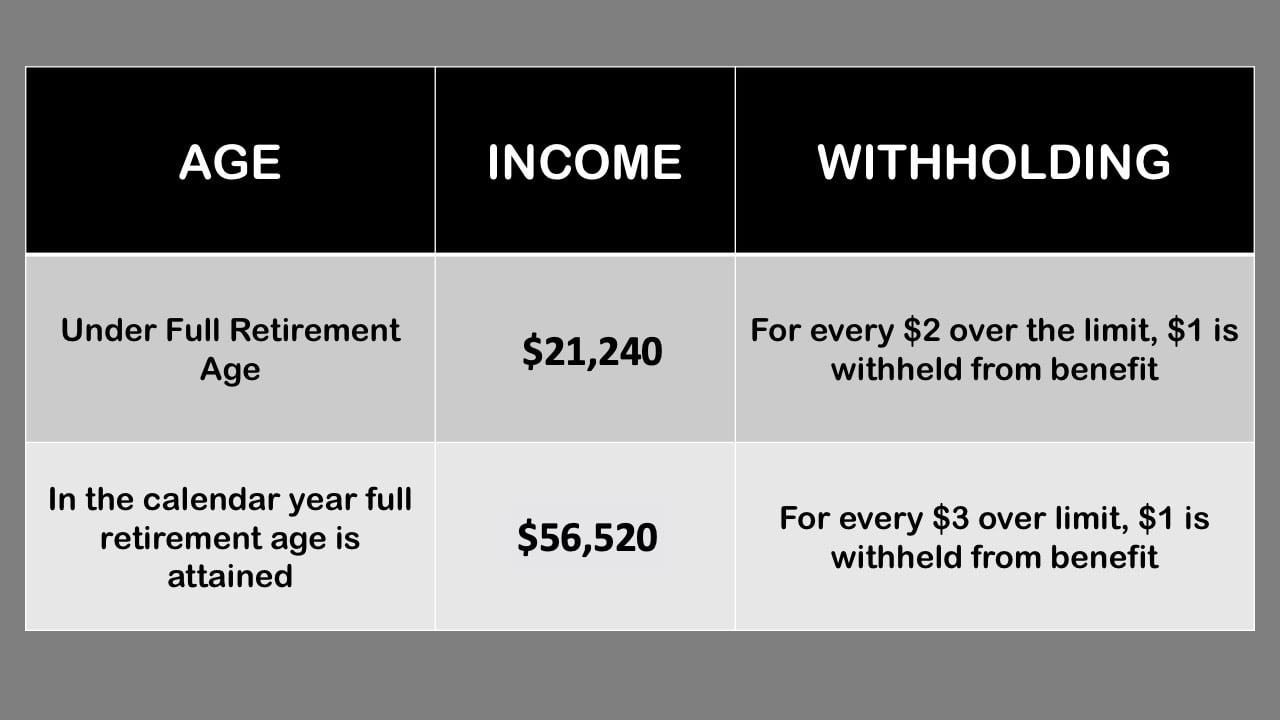

Social Security Limit 2025 Calculator Madeleine Avery, Those who will reach retirement age during 2025 will have $1 in benefits withheld for every $3 in earnings.

Social Security Tax Wage Limit 2025 Chart Leonard Lee, But that figure will rise to $176,100 in 2025 to account for increases in the average wage.

Annual Limit For Social Security 2025 Sammac Donald, Overview of social security wage base changes.

Learn About Social Security Limits, The initial benefit amounts shown in the table below assume retirement in january of the stated year, with.

Social Security Tax Wage Limit 2025 Opm Sophie Mackenzie, The initial benefit amounts shown in the table below assume retirement in january of the stated year, with.

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png)

Social Security Limit 2025 Alene Karina, This amount is also commonly referred to as the taxable maximum.

Social Security Limits 2025 Caril Cortney, The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each.